Is TSLA a tech stock or a fashion product?

Published: July 31, 2020Excellent article written by Olaf Sakkers on the pros and cons of Tesla. In summary-Tesla is today’s tulip craze.

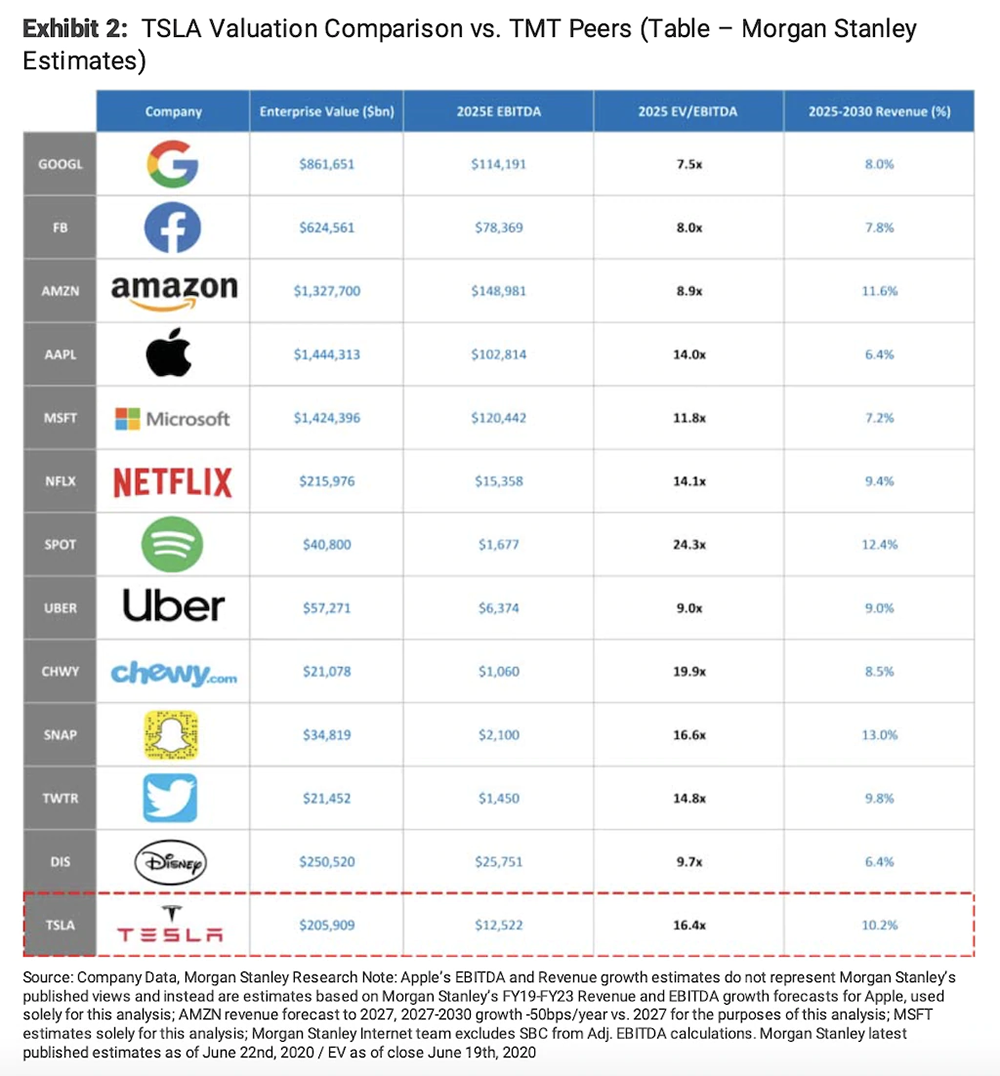

Tesla recently became the world’s most valuable carmaker. That’s pretty shocking since, as Morgan Stanley has pointed out, the company generates 0% of auto profits, 1% of auto OEM revenues and yet has 30% of sector market cap.

If Tesla wasn’t an industrial company that had to manage a complex supply chain, labor costs and distribution, it might be easier to understand how it could be valued at an EBITDA multiple well in excess of pure tech companies like Google and Facebook. Amazon’s significantly more capital intensive business might be the only comparable stock, but in that case, AWS is the primary profit engine and yet Amazon’s multiple is about half of Tesla’s.

An amusing illustration of the difference in scale between Tesla and other carmakers: during the challenging Model 3 ramp up, when Elon Musk was celebrating reaching a milestone of 7,000 vehicles manufactured in a week, a senior Ford executive pointed out that Ford is manufacturing this number of vehicles every four hours.

So if the 88,400 vehicles the Tesla delivered in Q1 of this year was less than 0.5% of vehicles globally, what explains this glaring incongruity? Here are two theories.

Theory 1: Tesla is a luxury handbag and Robinhood is a gaming company

Normally shares are commodities: units of ownership interest in a corporation that add up to the enterprise value. But in the case of Tesla, share ownership doesn’t just give the value of owning a portion of the company, but also confers additional value on the owner as a symbol of social status. A designer handbag isn’t just worth the sum of the materials it is made out of or the value it serves in carrying things around, but rather signals something about the owner which is the value we pay for in luxury. So too Tesla shares. They are luxury products.

In addition to the growth of this “luxury quotient” added to the stock value, the rise of retail investment through low cost trading platforms like Robinhood has made betting on Tesla widely accessible. There are now a lot more people who want to own TSLA shares because it means something and along with them, people who want to predict how the value will change. Given this, Robinhood is perhaps best thought of as a gaming company rather than a fintech company. Like real sports teams, Tesla has a lot of adoring fans along with bad guys to make fun of. And given that much of sports betting is on hold due to the global pandemic, more and more seem to be people looking for a good game to bet on.

There isn’t that much of a gap between this idea and what is known as the greater fool theory — an investment in Tesla is a bet that its current price will generate a return simply because someone else will come along and be willing to pay a higher price. A nice name for this is “momentum investing” and there’s clearly a significant amount of these dynamics driving Tesla to new highs but with significant volatility. While retail investment has become popular with individuals who might be the source of these trends, funds have turned increasingly to algorithm-based trading that follow momentum and can amplify the rise of fast moving stocks.

Theory 2: Tesla is a bet against the entire automotive industry

Beyond status symbols, games and momentum, are there any fundamental arguments for Tesla based on underlying value? What case might a thoughtful observer of the automotive industry make that could justify Tesla’s sky high stock price?

Obviously if Tesla’s valuation is thirty percent of automotive market cap, there’s an expectation that the company will grow revenues rapidly for many years to come and do so with significant margins. The arguments used to explain how it will do this have mostly involved fleets of robots:

- Dreadnoughts: One theory applies to manufacturing: Tesla is creating an “alien dreadnought” i.e. “the machine that builds the machine.” However, after a lot of Model 3 ramp-up challenges and some manufacturing tents, it now seems that “humans were underrated.” In China, Tesla’s manufacturing is increasingly outsourced.

- Robotaxis: The other theory claims that Tesla vehicles themselves will become a fleet of robotaxis. Yet Tesla’s autonomous promises have fallen spectacularly short of hype, and though Musk continues to claim that the technology is “very close,” the fact that his jazzed up prototype can’t yet get him to work without intervention (a milestone Waymo hit a few years ago) suggests there is still a long way to go.

Both of these robo-futuristic ideas have been pushed for some time and have been beaten into a trough of disillusionment in the eyes of serious observers, so it’s hard to argue that they are the catalyst driving Tesla’s stock price.

So if not robots, then what explains how Tesla is positioned to eclipse the automotive industry and justify its share price? This theory is a longer story and it starts with lego. And what it is that carmakers do.

What is a carmaker?

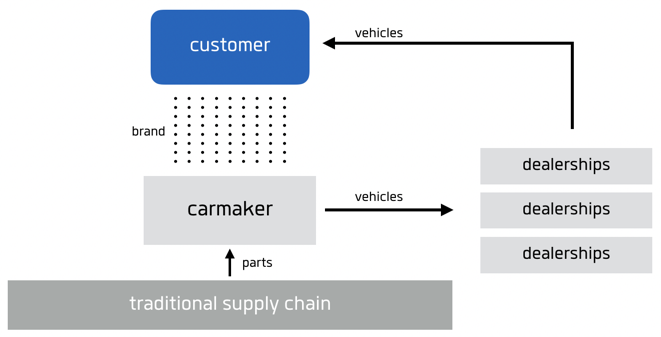

In Understanding business model disruption in the mobility industry, I noted that carmakers sit at the top of a complex supply chain, and essentially act as assemblers of various components — like blocks of lego — into a car.

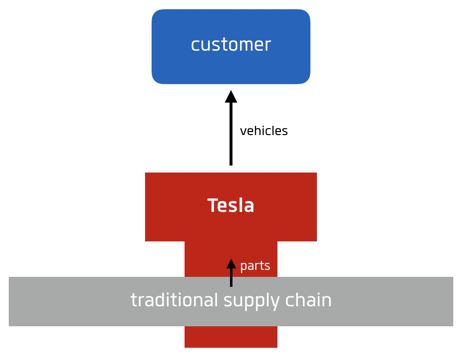

What makes Tesla different in terms of production is a significantly more vertically integrated manufacturing process, taking greater control of its components and supply chain. This not only applies to battery packs, but perhaps more significantly to electronics. Why does that matter?

Silicon

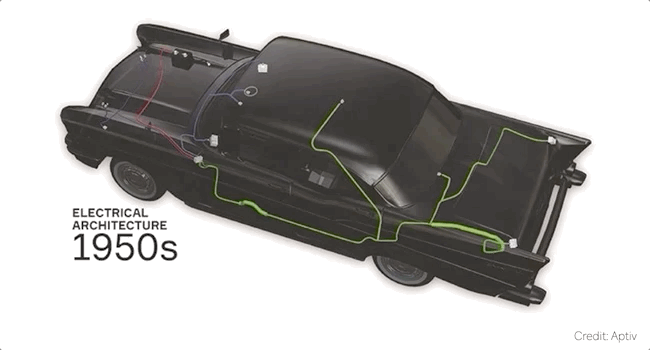

ECUs are computers in cars. They are encased in metal boxes and have to be wired and receive power. Just like other components, carmakers have treated ECUs like lego. They are simply blocks that form part of systems that they assemble into a functioning vehicle. Electric windows? Add an ECU to run the motor. Power steering? Add another ECU. The result has been an increasing bird’s nest of complexity as computation has been layered in to offer additional functions.

Initially this approach built off of what made carmakers effective — the ability to transform a complex set of components into a functioning whole. Over time, the teams developing new functionality were spun out from carmakers into “Tier 1 suppliers”, so that suppliers could focus more intently on the creation of optimal components while carmakers could focus on sourcing and assembly. This evolution rewarded carmakers since only those with scale and deep expertise could manage the increasing complexity including the supply chain along with testing and validation of new vehicles. Supporting them in achieving scale was a top down hierarchical culture defined by high standards of quality and reliability. However, as with all disruption, the thing that allowed carmakers to thrive is now becoming their fundamental weakness.

Software

The underlying silicon of vehicles is important because it affects what can be defined by software. A distributed network of silicon means a patchwork of software enabling each component’s functionality. Since ECUs are tied to particular vehicle functions (ABS, electric windows, etc), they are clustered around components into what are effectively intra-vehicle fiefdoms controlled by each supplier. Since software and hardware are intertwined in this way, the development and update cycles are set by the underlying hardware. System integration is needed just to make things work together. What automotive network architectures lacks is centralization and standardization.

It’s helpful to think of the various functions enabled by ECUs as similar to the standalone devices people owned before smartphones: a walkman for listening to music, a VCR for watching movies, a pocket calculator, etc — each with its own computational power and logic. Smartphones subsumed all that into one device with centralized compute, powerful operating system and software defined apps. A similar transformation is starting in automotive.

Software defined functionality

Tesla is markedly ahead of other carmakers in decoupling software development from hardware development. By vertically integrating its production, Tesla is able to include better silicon primarily into vehicle telematics and then layer upon that a software based operating system that allows more extensive control of core vehicle functions. One of the striking aspects of the Model 3 when it first launched was the absence of any controls besides the large iPad like touchscreen in the center console. Not only does this console include a markedly better routing experience through Google Maps, but it also allows things like the flow of air to be digitally modulated. The air vents have novel engineering that allows them to be controlled non-mechanically, but what is most interesting about the design is how it allows software to control the experience and the potential for this to extend across the vehicle. Tesla’s minimalistic cabin design may be extreme, lacking any tactile buttons to grasp while focusing on road or even an instrument cluster, but the message is clear: this is a vehicle that is in every way software defined.

OTA & update cycles

Most vehicles take about five years to design and features are set once the design is locked in. Perhaps the greatest benefit of software defined functionality is the potential to add new functions to vehicles at a much faster rate. Tesla does this through over the air (OTA) software updates, pushing out a new update once or twice a month. The result is a magical inversion: rather than buying a vehicle that is fully formed at purchase and from that point onwards depreciates in value, a Tesla promises to get better over time, adding new features and functionality, whether it is Sentry Mode, Tesla Theater, Dog Mode, Smart Summon or whatever other idea might come into Elon Musks head.

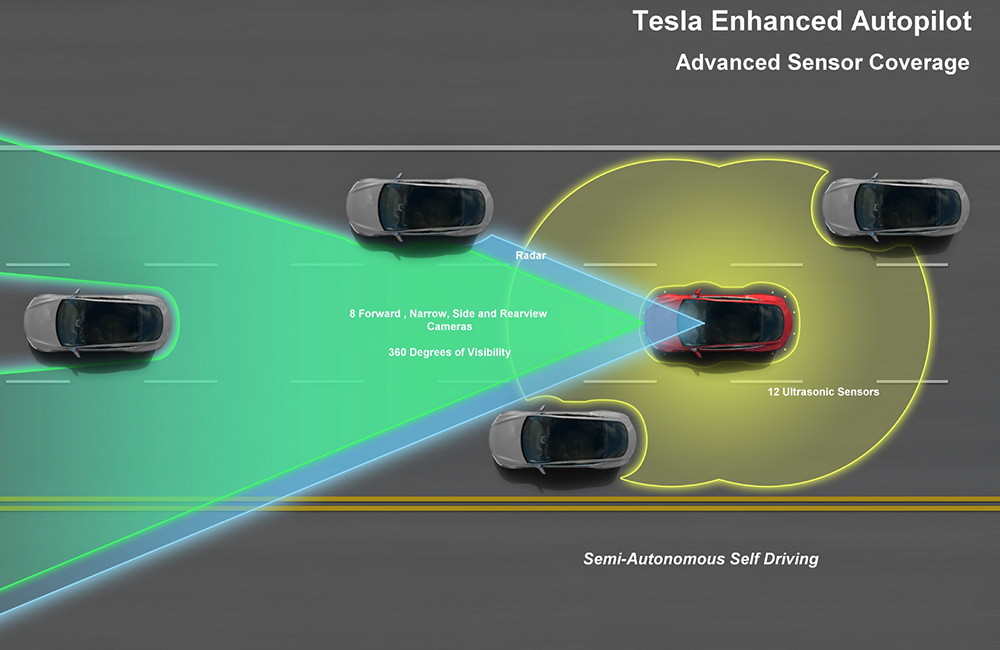

ADAS and autonomous technology

Nowhere is the promise of OTA and the value of networked vehicles clearer than in the autonomy halo that Tesla has created and actively monetizes through Autopilot and what it calls Full Self-Driving (FSD). The company charges $7,000 per vehicle on the promise that this feature will arrive in the future and the threat that it will cost more then. Not only are software updates steadily pushed that add new features such as the ability to identify traffic lights or drive on new roads, but the development of the system is also enabled by fleet-wide data capture. Tesla has heavily invested in sensors and silicon in its vehicles to enable this capture. The flip-side of the hardware-software decoupling is that hardware updates such as the addition of new sensors and silicon could be done within an existing production vehicle.

The company has received a lot of criticism for the way in which it has marketed autopilot, convincing some consumers that it is already a fully autonomous system, and as noted earlier, timelines have repeatedly slipped, but it is clear that Tesla’s system will continue to steadily improve along with the rest of the vehicle.

App ecosystem

Tesla’s current software advantage, both in terms of infotainment features and autonomous technology, has been built in-house. However, the potential to leverage third party developers is an intriguing idea.

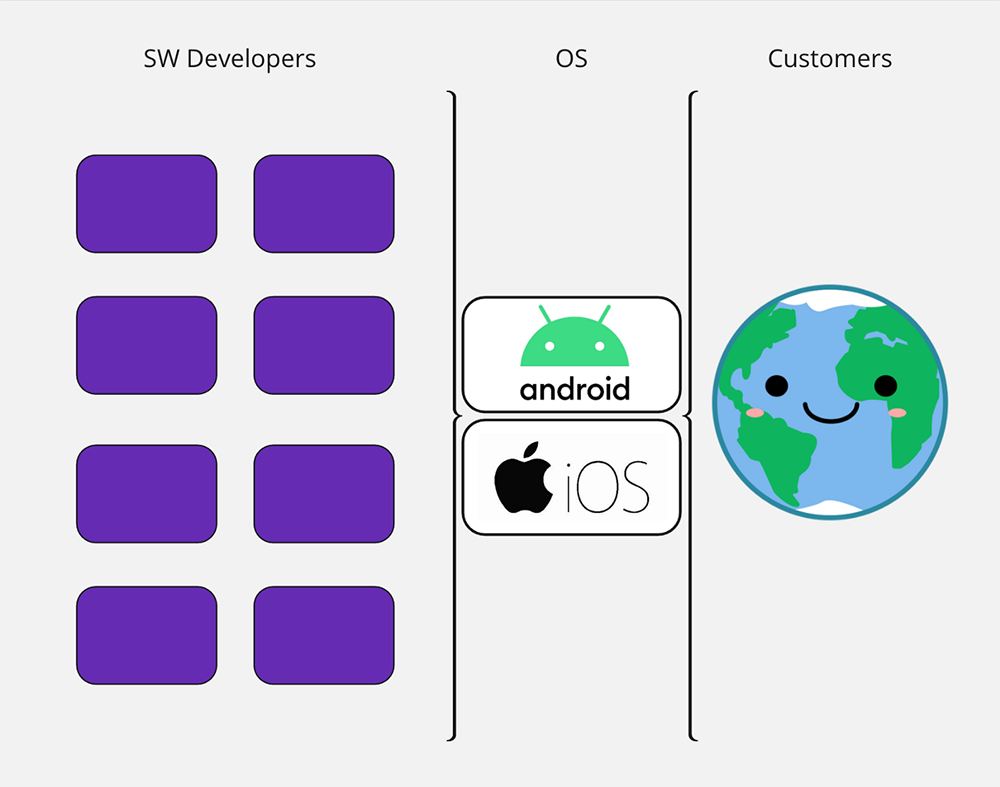

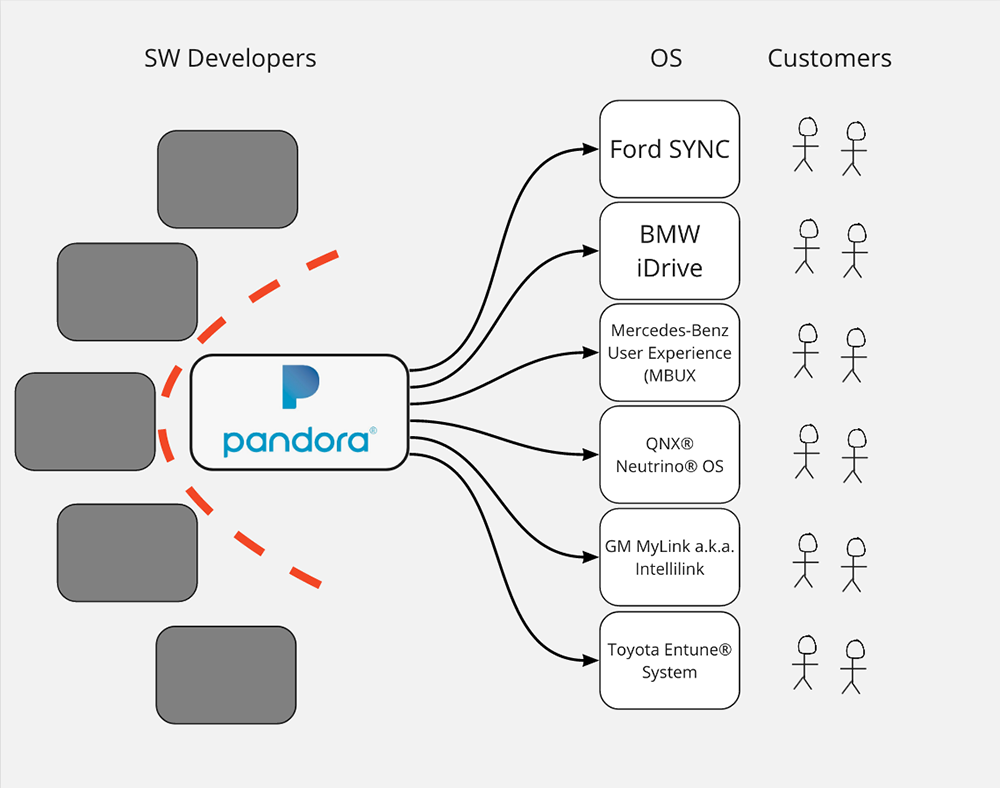

The most important thing that happened in the shift from feature phones to smartphones was the emergence of a third party developer ecosystem. The App Store transformed the iPhone from a phone with a web browser into a platform through which any company can address a huge base of customers. Today, a developer can build an app for Android and iOS and effectively address the entire planet.

In contrast, if a developer wants to build an app to run in all cars (and arguably Pandora/SiriusXM is the only company that has tried) she would need to build different apps for a dizzying array of different vehicle infotainment systems (some carmakers use more than one!). This is the legacy of the way in which carmakers have approached software and makes it very hard to leverage the creative power that has propelled the tech industry forward. (It’s worth noting that Google and Apple are now both extending their platforms into vehicles which is improving the user experience but ceding control of core functions to outside tech companies.)

One of the reasons that developers choose to build for the iOS first (ahead of Android) is that iPhone customers are a more valuable consumer segment (wealthier, earlier adopters and therefore more willing to pay). While Tesla doesn’t yet have massive scale and hasn’t opened up its platform to third developers yet, there is a strong case to be made that its customer segment has similar characteristics to early iPhone users and is therefore well positioned to build an app ecosystem.

It is yet to be seen whether cars can offer anything close to the flexibility to enable new experiences that smartphones do. But there seem to be some interesting possibilities: audio interfaces including voice assistants, in-vehicle cameras, safe productivity tools, new kinds of games combined with location data. Or deeper aspects might be manipulated in new ways such as a more performative kind of AWD or driver scoring for insurance. It’s hard to know what might work, but just as it was hard to predict that Snapchat and TikTok might build huge business on the back of mobile devices when they first launched, it is at least plausible that a third-party app ecosystem might create significant and sustained value if given the right set of APIs.

Cybersecurity

Cybersecurity isn’t so much a feature as a foundational requirement for new kinds of digital experiences. One of the telling consequences of the lego-block approach to digitization that OEMs have taken is that cybersecurity risk has emerged as a result of incremental digitization. Heterogeneity creates vulnerability — since there are so many different ECUs across the vehicle running different software, there is a very broad attack surface area along which hackers can find a vulnerability. Already five years ago vehicle cybersecurity was put in the spotlight forcing a major real-world recall, yet little has been done since then to mitigate the risk. Tesla’s vertical integration and software-first approach are once again an advantage and this is likely to become more important as cybersecurity risk in vehicles becomes more apparent to consumers. Failing this, Tesla’s OTA capabilities could help it quickly distribute patches for vulnerabilities that appear.

Clockspeeds and compound growth

Tesla ranked in last place on a recent JD Power quality survey of carmakers, reporting an average 2.5 problems on each vehicle. A large part of why this doesn’t really impact consumer perceptions is the sense that Tesla is on a rapid development curve. While many of the promises that Tesla makes are delayed or scrapped (LA to NY in autonomous mode!, electric big rig!, blah blah blah) what matters is that some of the promises do come through, making all the others seem plausible. A broken cupholder or misaligned door seem of little consequence when considering a product that rides a magic carpet of digital compounding returns powered by the Singularity and hallowed by Elon Musk’s cult of personality. In contrast, other carmakers seem flatfooted on all things digital. It seems to be a foreign tongue and to the extent that they compete on this front, they dance to a rhythm that Tesla has set. Only now are other brands launching OTA functionality, almost a decade behind Tesla which started in 2012. Daimler’s recent partnership with Nvidia to create vehicles offering OTA and advanced ADAS by 2024 looks like a Tesla press release from four years ago, just less exciting.

Adding it up

So the argument that Tesla is priced “correctly” goes as follows: Cars are becoming digital through silicon centralization and function defining software built on top of it. Tesla has chosen to vertically integrate and is way ahead of incumbents especially when it comes to software updates, shorter update cycles and cybersecurity, giving it a sustained advantage. Software is what propels Tesla forward and what holds its incumbents competitors back. Betting on Tesla is a bet that software advantages are deeply rooted and will continue to deliver sustained competitive advantages through novel functionality and that these advantages will only grow with greater access to capital and scale. And it is also a bet against the rest of the automotive industry — that it can’t catch up, leverage its currently far greater scale and specialized supply base to tap into the same digitization that has allowed Tesla to succeed.

What to watch

Bull and bear cases are helpful as they highlight the extremes between which reality usually plays out. Part of the reason the handbag-gaming theory makes sense is because Tesla brings something new and different and has a very compelling story. But what does the digital disruption bull case teach us about the rest of the automotive market? Here are a few things to look out for going forward:

- Other disruptors: Tesla isn’t the only company carrying the flag of digitization, free from the burden of legacy capacity and culture. There is a host of other companies vying to ride a similar wave and raising excitement (and wild multiples) from investors. Some companies to watch include Nio, Nikola, Rivian, Lucid, Xpeng, WM, Arrival and Rimac.

- China: Three of these disruptors are Chinese startups — Nio, Xpeng and WM — but there are also several Chinese carmakers that have been around for longer and grown powerful selling into the Chinese market, the largest in the world. Chinese carmakers have been catering to Chinese consumers and are therefore more focused on digital experiences. Meanwhile EVs have been strongly incentivized by the state. These companies are now increasingly interested in expanding beyond China. Most notable amongst the Chinese players is Geely which has made a series of smart acquisitions (most notably Volvo Cars) and large strategic investments (including in Daimler, the parent company of Mercedes).

- Supplier innovation: What incumbents still have is scale and capital coupled with a resourceful supply chain that has strong interests in preventing vertically integrated carmakers from taking over. Suppliers are realizing that future business will not depend just on components within specific focus areas of the vehicle (powertrain, seating, head units, active safety, headlights, etc) but also on the vehicle’s broader network architecture and are therefore moving upstream. Most notable among them is Aptiv, which shed its legacy business through a spin out, and has since been positioning itself to supply what its calling Smart Vehicle Architecture (SVA) in the next generation of vehicles. This is a network architecture with powerful centralized compute and simplified communication and power connections allowing a foundation for better infotainment experiences as well as autonomous functionality.

- Standards and open innovation: On the back of a centralized network architecture, carmakers need to find a way to standardize software development to leverage the power of open source development and rapid update cycles. While Tesla’s vertical integration means most of its technology is developed in-house, other carmakers can use open innovation to catch up. However, startups looking to partner with carmakers have faced significant hurdles since the industry has yet to find effective ways to partner, let alone a common foundation to build upon. Figuring this out is essential.

- The autonomous tortoise race: One example of where collaboration has worked fairly well is in ADAS systems. Though autonomous technology has fallen short of hype, it is still a very disruptive long term trend. Autopilot has received a significant amount of attention, but carmakers are rolling out ADAS systems with arguably better user experiences than Tesla, mostly powered by Mobileye’s technology. Meanwhile, autonomous vehicle developers such as Waymo are forming deep partnership with carmakers while others such as GM and Ford have made major acquisitions. Both channels of development are a reminder that many carmakers are aware of the challenge ahead and are finding ways to respond.

- Consolidation: Carmakers hold an important position as national champions and governments treat them as too big to fail. The US bailout of GM during the Global Financial Crisis was emblematic of this, but Germany, France, Japan and Korea are all very involved in supporting domestic carmakers too. At times, this has prevented consolidation when it has made sense. However, the significant capital requirements needed to develop new electric vehicle platforms and autonomous technology are pushing carmakers such Honda and GM and Ford and VW closer together. There are also partnerships that allow greater vertical integration such as Aptiv’s $4 billion JV with Hyundai to develop autonomous technology. PSA and FCA are already in the midst of a merger and there may be more to come. Digital transformation will accelerate and be accelerated by these trends.

- Culture clashes: Yet change remains difficult and there are strong forces within each established carmaker that will fight to maintain the status quo. Each ECU has a place in the org chart with an executive behind it with a vested interest in its survival. VW just fired Christian Senger, the executive who had been tasked with centralizing their software development and CEO Herbert Diess has been significantly weakened after a showdown with supervisory board. And let’s not talk about Carlos Ghosn. Will executives have the freedom they need to push forward the change that is needed? Will carmakers succeed in forming new R&D centers or acquiring startups in innovation ecosystem and graft them onto the core of the organization? Can they make faster decisions and tolerate greater risk to bring speed up technology development? GM and Aptiv have both benefited significantly from restructuring and subsequent acquisitions and have been rewarded to some extent by public markets. But changing culture is hard.

Storytelling

Another thing that is hard to change is a narrative. We live in an era in which stories shape reality almost as much as reality shapes stories. Tesla’s momentum is built on both technology and theatre. Industrial companies are predictable and boring. Tesla is not. It is painting a vision of a future that is new and that people want to be a part of. Carmakers need to transform themselves to be competitive on technology, but they also have to figure out how to transform what people think of them. In spite of the fact that GM has created a new EV platform with a futuristic name, has a leading AV development project backed by unicorn hunting Softbank and sells eight times as many cars as Tesla, its enterprise value is just an eighth of Tesla’s. Investors simply don’t believe it can grow dramatically or unlock new revenue streams. In this regard carmakers would do well to learn from Gucci. Fashion is built on stories. Handbags do more than just carry stuff. As do cars.

Read the original here.

- Sophisticated Financial Advice

- Preeminent Strategic Advisors

Contact Us

9174 Highland Ridge Way

Tampa, FL 33647